Cost of Selling a House with a Realtor in 2024 [Video Guide]

Even though the information on this web page is provided by a qualified industry expert, it should not be considered as legal, tax, financial or investment advice. Since every individual’s situation is unique, a qualified professional should be consulted before making financial decisions.

Unfortunately, selling a house not only means making money, but also spending some amount before the closing day even comes. There are many confusing fees and other expenses included in the total cost of selling a house, and they vary depending on the situation.

To help homeowners learn about how much will cost them to sell their house, we asked Kristina Morales, a licensed and highly-experienced Realtor from Orange County, California to shed some light on this subject.

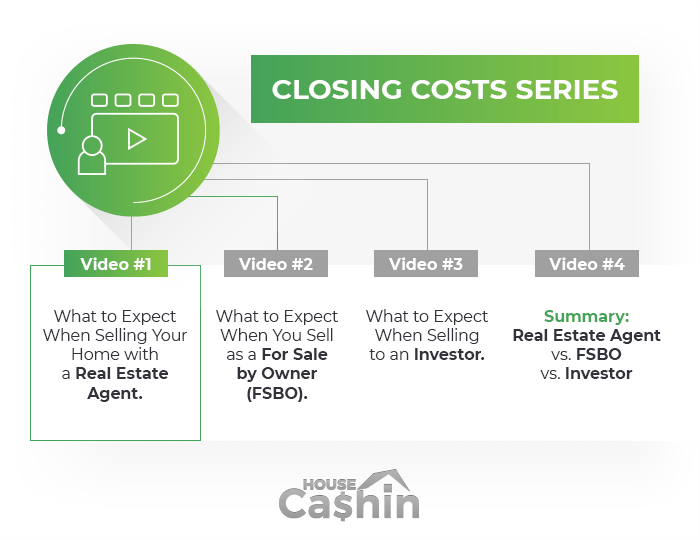

Kristina took her time to record four videos explaining in detail all the possible closing costs homeowners can expect to pay during the following three types of real estate transactions:

- Cost of Selling a House with a Realtor (presented on this page)

- Cost to Sell a Home by Owner

- Cost to Sell a Home to a Real Estate Investor

- Closing Costs Comparison: Realtor vs. FSBO vs. Investor

How Much Does It Cost to Sell a House with a Realtor in the US?

In the following video, the first of this series, Kristina explains the typical fees and hidden closing costs associated with selling a home through the first type of transaction—selling a house with a real estate agent.

She also gives an example of how they are deducted from the amount paid by the buyer, so after watching it you will be able to approximately calculate how much profit you will make if you sell your house with a Realtor.

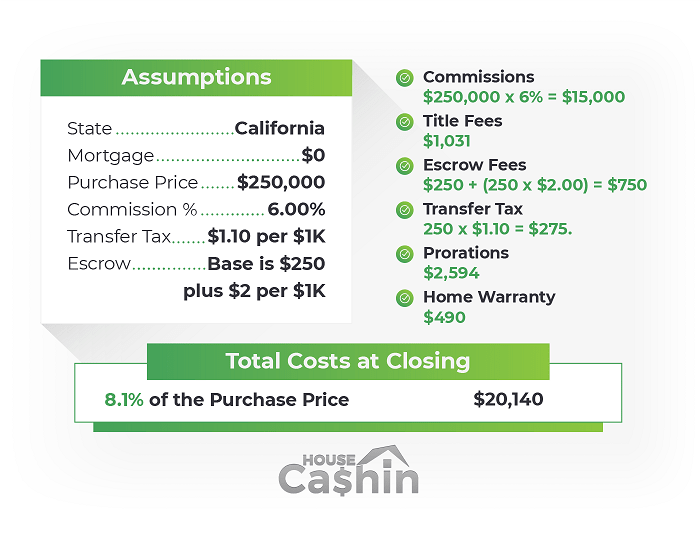

Infographic: Cost of Selling a Home with a Real Estate Agent

To help you remember all information provided in the video, we summarized it in this infographic. Feel free to share it with your friends and colleagues.

Video Transcription

For those who prefer reading rather than watching a video, here is the transcribed version:

Hi everyone. My name is Kristina Morales and I’m a licensed real estate agent in the state of California. Today I am going to be presenting video one of the closing costs series. In this video, we’re going to discuss what to expect when selling your home with a real estate agent.

First thing to note is to each his own. And what that means is that both buyers and sellers have closing costs. Home sellers have higher closing costs because they typically pay for the real estate agent commissions. Now let’s take a moment to briefly discuss real estate agent commissions and how they work.

What Influences the Realtor Fees

The first and most important thing to know is that commissions are always negotiable. They can vary by location, price, and brokerage. When I say location, I mean that depending on where you’re selling your home, you could be selling in a buyer’s market or you could be selling in a seller’s market. This can influence the commission rate being charged.

Also, some influences could be the price point as well as the brokerage because each brokerage independently decides on the commission rates that it will charge.

If you’re going to go with a full-service brokerage, you can expect to pay anywhere between 5-7% of realtor fees on average. And an important thing to note is that the commission being paid is split 50/50 between the buyer’s agent and the listing agent.

Out of Pocket Expenses

In this presentation I have broken out closing costs into two categories: out of pocket expenses and closing costs that are netted from proceeds.

What I mean by out of pocket expenses, these are the items that you’ll pay for before closing happens. So let’s walk through the typical out of pocket expenses that you’ll see.

Home Repairs

The first one you’ll note is home repairs. And this is in the preparation phase of selling your home. Before you put your home on the market, you do certain things to prepare your home for sale. And one of those things could be home repairs: fixing things that you know need to be fixed before you put it on the market. The reason you’ll want to do that is because it’s important that your home is ready so that it shows at its best when buyers come in.

Home Staging

Another expense you could have during the preparation phase is professional staging. Not every seller chooses to do this. I’m a huge proponent of professional staging because staging a home can not only increase the speed of what your home is sold but can also increase the price at which it’s sold. So, professional staging is definitely something you’ll want to discuss with your realtor, to see if it’s something that you need and if it can help enhance your home to buyers.

Home Inspections

Once you get an offer, you go into escrow. The beginning of the escrow period is called “The Contingency Period”. And that is the period in which buyers have time to go through their residential real estate due diligence checklist. They’re going to be doing inspections, reviewing documents, and making sure that they know exactly what they’re getting into when they purchase your home.

An inspection that you often see sellers cover is the termite inspection (at least in my area). Oftentimes the sellers will pay for the termite inspection (and they could also pay for termite treatment, if any findings come upon that inspection).

The other thing to expect is a request for repairs. After the buyer has done their inspections, things come up that they didn’t anticipate. And so they’ll come to the seller and say “I didn’t anticipate these items when I made my original offer. I would like you to fix them or I want you to give me a credit against the purchase price. Because I’m going to have that expense, and what I offered you didn’t anticipate those repairs.”

In California where I’m at, a seller can do a few things:

- They can fix everything that’s on that list.

- They can choose which items they want to fix.

- They can decide to give a certain amount in a credit back to the buyer.

- Or they can completely ignore the request for repairs.

But there is potential that you could have some expenses in getting things corrected in order to proceed with closing.

Point-of-Sale Inspections

While I’m in California now, I’m originally from Ohio, and in the county that I grew up in, there was a point of sale inspection if you have a well or septic, and the county requires that inspections are done before ownership is transferred. That could be an expense for the seller. It could also be an expense for the buyer, but it is a potential seller’s expense. Note, I wanted to make you aware that you’ll want to make sure that you don’t have any point-of-sale inspections in your area.

HOA Fees

Another fee that you’ll see is the HOA fees. So as a seller you have an obligation to provide the buyer with all of the HOA documentation so that they can review the rules and regulations that the HOA has imposed on the property. And the HOA will charge the seller a documentation fee. They will also charge the seller a member transfer fee.

The member is whoever owns the property, and because you’re selling it to someone else and a new owner will take the place of the previous owner, there could be a fee to transfer that membership.

Costs Netted from the Proceeds

Title Services

Some closing costs you typically see netted from proceeds are title services. A title company ensures that a clear title is being transferred. If there’s anything that they need to note, any issues with taking the title, that’ll come from the title report, and they typically will charge a percentage of the purchase price.

Escrow Services

Escrow companies are neutral third parties who carry out the written instructions provided by the seller and the buyer. And that’s the agreement that you came to. So they ensure that all of the things are met.

They typically charge a base rate. Somewhere between $200-$250 where I’m at. And then they charge $2 for every thousand in the purchase price. So if you take $250,000, which will be in our example, and you divide that by a thousand, you have $250. That $2 would be charged against $250.

Note, not every area has a separate title and escrow company. In California I have a title company that I work with. I also have an escrow company that I work with. But in Ohio, the title company is the escrow agent. So just note that in your area it could be different. And the important part is to know you’ll have title fees and then you’ll have escrow agent fees.

Transfer Tax

Transfer tax is a county, city, or state tax on the change of ownership. And that can be calculated as either a percentage of the purchase price or a set price per thousand.

Property Taxes

You’re going to owe your prorated share of the property taxes. If you’ve prepaid taxes, you’ll get a credit back for anything that you’ve overpaid. And that’s going to be based on when things are due and paid in relation to the closing date.

Mortgage

If you have a mortgage balance that’s going to be deducted, it’s also going to be prorated for the interest in fees. That’s will be prorated based on when you held the property and when it was due. So that’s a prorated number and that comes out of proceeds as well.

HOA Dues

If you pay monthly, quarterly, or annual HOA dues, you’re going to be responsible for the prorated share of those dues and that’ll be deducted from your proceeds.

Closing Costs Example

Now let’s walk through a very general example of how it works. We’re going to assume that the purchase price is $250. For simplicity’s sake, I’m saying there’s no mortgage balance. The commission being charged is 6%. At the escrow fee, the base is $250 and then they’re going to charge $2 for every thousand of the purchase price.

The transfer tax is going to be $1.10 per thousand of the purchase price. And we are selling in the state of California.

Commission

If you’re selling a home for $250,000 and you’re paying your real estate agent 6%, then in commissions, you would have paid $15,000. Again, note that your listing agent isn’t receiving that full $15,000. It’s going to be divided between agents and then brokerages.

Title Services

I just used my title company schedule. So at $250, they would charge $1,031.

Escrow Fees

Again, the basis is $250 and then as $2 for every thousand of the purchase price. So that comes out to $750.

Transfer Tax

Transfer tax is $1.10 for every thousand of the purchase price. So it’s $250 times $1.10 and that’s a transfer tax of $275.

Prorations

I just did a plug number and we’re going to say that for this example, HOA is anything that is due, and it’s $2,594.

Buyer’s Warranty

I didn’t mention this earlier, but typically you’ll see a seller paying for the buyer’s warranty—a home warranty. If anything major breaks down in the home and within that first year, the buyer has a warranty that will cover it, so the seller will usually pay for the first year. And then if the buyer wants to continue it, they pay any subsequent years.

Summary

So let’s do a quick summary of what that looked like.

Commissions at $15,000, prorations at $2,594, the title policy is $1,031, escrow is $750. The home warranty is $490 and the transfer tax is $275 for a total of $20,140 or a 0.1 of the purchase price, which is in the range because the average closing costs for selling a home range anywhere from 6-10% of the purchase price.

The Closing Costs Video Series

As I mentioned, this first video is about how to estimate closing costs if you are selling your home with a real estate agent. In video two, we’re going to be discussing what your closing costs would look like and what you can expect when you sell as “for sale by owner” (also known as FSBO).

And then, at last, we’re going to talk about what to expect in closing costs when selling to real estate investors. Then we’re going to put it all together, and there’s going to be a video that will summarize what your closing costs look like when you use a real estate agent versus when you sell “by owner” or when you use an investor.

I hope this was helpful and that you have a little bit of clarity around closing costs involved in selling a house with a real estate agent. Of course, if you have any questions or require any more information, feel free to visit HouseCashin.com until the next video. Have a great day.