A-to-Z Guide to Selling Your Rental Investment Property in 2024

Even though the information on this web page is provided by a qualified industry expert, it should not be considered as legal, tax, financial or investment advice. Since every individual’s situation is unique, a qualified professional should be consulted before making financial decisions.

When you are evaluating how to sell a rental property, you should determine what exactly you are selling and to whom. A residential investment property will either be sold as:

- a residence to a homeowner

- or an investment property to an investor.

Then you will likely want to minimize (or even avoid) Capital Gains Tax on the sale of your property.

As an experienced real estate investor buying and selling properties on a daily basis, I am going to walk you through the sale of a rental home so that you can protect your investment and get the best possible return.

2 Best Ways for Selling Your Rental Property

#1 Traditional Sale

When learning how to sell a rental house, you will need to consider the traditional way of selling residential property. This will involve listing your house for sale to the general public.

How a Traditional Property Sale Works

In a traditional real estate sale, you will first want to make your property presentable. Curb appeal is important. The exterior and interior of your property should be in good repair and the landscaping trimmed and mowed.

If you haven’t kept up with the maintenance on your property, and you haven’t set aside reserves for repairs, this may mean coming up with funds to prepare the house for listing.

When you put your property on the market, you can either have a real estate agent list it for sale or do it yourself.

An agent will place your house on the region’s Multiple Listing Service (MLS). This will make all the details of the property available to thousands of buyers’ agents in the area. This includes data that is not available at real estate websites open to the public.

Your agent will handle all negotiations, inspections, and documentation that is needed for a residential property closing. Otherwise, if you try to sell your property for yourself, you will have to handle all these tasks.

Frankly, the only valid reason for selling your property without an agent is to save on commissions. Broker commissions are the largest closing cost that a seller will have. Normally, it’s about 6% of the selling price. This amount is divided between the seller’s and buyer’s agents.

But bear in mind that even if you sell the house yourself, you will likely have to pay commission to a buyer’s agent. Usually, it’s half of what you would pay if using a listing agent. According to the National Association of Realtors (NAR) survey 2018 Profile of Home Buyers and Sellers, 87% of buyers used their agent. So it’s unlikely that you avoid all 6% of realtor fees.

If you want to learn more about closing costs, you are welcome to read our articles that thoroughly study closing costs for sellers in different scenarios:

- Cost of Selling a Home with a Realtor

- FSBO Closing Costs and Fees When Selling a Home by Owner

- Closing Costs for Home Sellers

The majority of homeowners will need to borrow most of the purchase price. If there is deferred maintenance on the home that wasn’t kept up with, a mortgage lender will insist that the work is done before closing.

Sometimes, even though the buyer was pre-approved in advance, they are declined by the lender.

The public often has the opinion that renters don’t take good care of the properties that they live in. This may be a hurdle that you will have to overcome.

In a traditional sale, unless there is a problem, you can expect to close 6 to 8 weeks after agreeing to a contract to sell your property.

Advantages of a Traditional Property Sale

There is only one advantage. A traditional sale of your property will attract the largest number of potential buyers. This means that, depending on the housing market in your area and the condition of your property, you may get a higher price for your home in a traditional sale.

Disadvantages of a Traditional Property Sale

- The buyer’s mortgage lender can impact the sale by either delaying it or making it fall through.

- A traditional sale may take from two to six months to accomplish, depending on the market and the condition of the property.

- Closing costs paid by home sellers normally comprise about 8% from the sale price.

- If you have tenants in the house, it will be difficult to show. Open house events will most likely be out of the question.

- Buyers will be turned off by any remaining maintenance work or updating that needs to be done. They will be quick to select other homes that are “move-in ready”.

#2 Selling to a Real Estate Investor

If I want to sell my rental property, I would consider the option of selling to another investor. Let’s go over this method to see how it works and its pros and cons.

How Selling to a Real Estate Investor Works

The biggest difference between this method and the traditional way to sell a house is that the transaction involves one professional selling to another. Usually, a broker is not involved.

Your marketing will consist of contacting qualified investors and presenting the opportunity to them.

Investors will handle inspections and value calculations for themselves.

It will still be good to make the property presentable. If that isn’t possible, it won’t stop investors from considering your property for purchase.

Investors pay cash for rental homes. This eliminates lenders and third-party appraisers and inspectors. The only person who needs to approve the property is the buyer.

Advantages of Selling to a Real Estate Investor

When you sell directly to an investor, you simplify the entire process:

- Investors pay cash. You remove the uncertainty of the lender’s approval of the property’s condition and the buyer’s credit score.

- An investor can close much more quickly. You may even be able to set a closing date that is convenient for you.

- Normally, investors assume all closing costs except for the prorated share of property taxes owed and HOA dues (but this is also negotiable). Broker commissions that cost thousands of dollars are eliminated.

- Investors buy rental properties as-is. You won’t have to pay repair expenses out of pocket.

- If you have tenants in place, you won’t have the difficulty of arranging repeated showings to the general public.

- Because they pay cash, and because they can calculate the property’s market value for themselves, investors don’t need a formal appraisal.

Disadvantages of Selling to a Real Estate Investor

There is only one disadvantage.

Investors will consider the costs of any needed repairs and their desired profit margin when deciding on a price for your property. Depending on your market and the condition of your rental home, an investor’s offer for your home may be below market value.

However, investors have also shown an interest in purchasing well-maintained homes in desirable neighborhoods. Offers for these homes have been comparable to offers from homeowners.

To learn more about how investors calculate the price they are ready to offer for a home, read our guide on selling your house to an investor.

How to Get the Best Cash Offer

The best scenario is having multiple investors start a bidding war over your house or condo and then choosing the best offer. This means that you need to market the property to as many prospective cash buyers as possible.

Of course, you can start searching “we buy houses fast for cash” online, doing research on each company’s background, and if it’s good, requesting cash offers from them one by one. However, there is a more efficient strategy to get multiple cash offers much quicker.

You can achieve this in two steps:

Step 1: List your house or condo on the HouseCashin investment property marketplace. This will:

- immediately make it available to numerous investors who are using the marketplace to search for investment opportunities in your location.

- automatically send an email blast to all investors from HouseCashin buyers list whose property buying criteria match your listing.

Unlike other websites such as Realtor or Zillow, where people also list their properties for sale, HouseCashin marketplace is created specifically for investors.

You won’t have to filter out irrelevant offers from the general public looking to buy a property through the lengthy traditional process involving mortgage approval and real estate agents.

Step 2: In addition to step 1, to increase your reach even further, you can request a cash offer directly from HouseCashin’s network of qualified real estate investors.

We have thoroughly researched the background and experience of all investors registered as property buyers in our network.

By using the simple Request a Cash Offer online form, you can quickly receive up to five offers for your property and choose the best one.

When you use HouseCashin, you increase the scope of your marketing with the confidence that you are dealing with the right buyers.

How Much Should I Sell My Rental Property For?

The most common valuation methods for calculating a rental home’s value are the Sales Comparison method and the Income Approach.

Other formulas are used to keep up with an investment property’s performance such as Internal Rate of Return (IRR) and Return on Investment (ROI). The two methods that we’ll discuss here are used most often to come up with a sale price.

Sales Comparison Approach

Sales Comparison is the method used by appraisers for residential properties being bought by homeowners.

This is done by comparing the closed sales of homes that:

- are most similar to the subject property,

- are closest geographically to the subject property,

- have sold most recently.

Adjustments are made to the comparable sales if necessary to make them more like the property for sale. The appraiser will add or subtract from the sales price of the comparable homes if they are inferior or superior to the subject property.

The average adjusted sales price of at least 3 comparable sales will be used to determine the value of the subject property.

You won’t have the appraiser’s reference materials for making adjustments. It’s important to use comparables that are as similar to your property as possible.

Be careful of using price per square foot for comparisons. This only works if the floorplans and usable square footage of each house are very similar.

Income Valuation Approach

A landlord selling rental property is also selling an income generating asset.

For this reason, the Income Approach is often used when evaluating rental properties.

The Income Approach is a calculation of the investment’s financial return that can be used to determine its value.

When you divide the annual net rental income from your property by its price, you get its Capitalization Rate or Cap Rate. You can also divide the income by the current market Cap Rate to find the property’s value.

For example, if your property generates $1,550 a month in net operating income (NOI) that would be $18,600 NOI.

If Cap Rates in your area are 9.5%, then the approximate value of your property should be $18,600 / .095 = $195,789. You would set the price slightly higher to allow for negotiating.

Make sure that you are ready to document your property’s income history with financial records and tax returns.

Which Approach to Take?

Residential buyers will only be interested in values from the Sales Comparison method. If the housing market is strong in your area and you have the time to sell the traditional way, you might make more money using the Sales Comparison method.

If home sales are weak and the demand for rental houses is strong, the Income Approach can help you achieve a higher price for your property from investors.

If you are selling a house that needs major repairs or you need to close quickly, you may need to price your home to fit an investor’s immediate needs.

A rental house provides you with both cash flow from rents and the appreciation of the asset when you sell. Sometimes when you are setting your sale price, it helps to remember the rental income you received and your overall return.

What to Do if I Want to Sell the House but Have Tenants in Situ?

What if you are selling a house that has renters in it? Selling a house with tenants doesn’t have to be a problem for your property investment exit strategy.

Having an active lease in place with tenants who are in good standing can be a plus to an investor.

Tenant rights are established at the state and local level. You need to be aware of the laws and regulations in the municipality where your property is located.

Tenants’ Rights

Your tenants’ rights don’t go away when you sell the property. You have given them a leasehold interest in your property for the term of the lease. In some cases, their property rights override yours.

If the lease has expired but you have allowed them to stay, the lease has become a month to month lease. Even then, the tenant still has rights.

The buyer of the property will almost always have to honor the terms of the lease. One exception is when your lease has a “lease termination due to sale” clause. In that case, the tenants will have to leave. You will still have to give them a written notice of at least 30 days.

A few places in the US allow Owner Move In (OMI) evictions. If the new owner or a family member is going to live in the property as their primary residence, then the tenant will have to move. This will apply if you are selling your house the traditional way to the general public.

In all other cases, the tenant’s rights under the lease continue with the new owner. This includes their right to a return of any security deposit. You will need to give the buyer of the property a credit at closing for that amount.

You will have to continue to meet your obligations under the lease while selling your property. If this is a financial strain for you, a quick sale may be your preferred option.

Tenants’ Cooperation During Showings

Selling a house with tenants in it can create complications when you are marketing to the general public in a traditional sale.

Tenants across the country are protected from the inconvenience of property showings at some level. Most places require reasonable notice of showings. Almost half of the states make you give your tenant 24 to 48 hours notice of a property showing.

Tenants usually don’t have to leave the premises or even clean up the house before showings. You can always give them an incentive to leave during showings by giving them a gift card to a coffee house or restaurant.

If tenants are aware that the house is being sold to a buyer who will occupy the property, they have little incentive to cooperate with you during the marketing of the home.

When they know that the buyer is another landlord, it is more likely that you can enlist their help in the sale process.

Investment properties with a tenant in good standing are more valuable to an investor than a vacant property.

Evicting Tenants and Selling the Property

What if you want to, or need to evict your tenants before selling your rental house?

Once again, you’ll need to be familiar with the laws in your state and your municipality before taking any steps to evict.

You can’t evict a tenant without good reason. They will have to have defaulted on their lease obligations in some way for you to have a reason to evict.

A written eviction notice will have to be delivered to the tenant. You’ll need to affix the notice to the property and send it to the tenant by certified mail.

The notice should tell them specifically what they have done wrong. It helps to reference the section of the lease that was violated.

Your laws may require you to give them a chance to remedy the situation. If so, give them a deadline to do what needs to be done or they will have to vacate the premises.

You need to file the notice with the court. Check to see if you have to wait a certain amount of time after giving the tenant the eviction notice before you can file.

You may need to consult an attorney before starting down that path.

Trying to evict a tenant by yourself is illegal everywhere in the US. This means that even if they are in default you can’t try to force them to leave. This includes removing their personal property, cutting off the utilities, changing the locks, or otherwise making it difficult for them to live there.

Your life might be easier if you can buy them out of the lease by offering to pay for their relocation.

The Fastest and Easiest Way to Sell Your Rental Property

When you are looking at how to sell an investment property, it’s pretty obvious that the two methods discussed here have distinctive pros and cons.

While some buyers who want to live in the home may be interested in looking at your property, investors will definitely want to know about it.

If tenants are living in the house, it will be difficult to show it to the public. If the house is a vacant former rental property, it may not be as desirable as other properties to the typical buyer.

On the other hand, a rental house with tenants is very desirable to investors. When they know that there is existing cash flow in place, they will put the income generating property you are selling high on their list.

Using HouseCashin can be your marketing strategy. When you take advantage of the HouseCashin marketplace and quick and easy Request Cash Offer online form, your property will be placed in front of the investors that you want to reach.

Then you will just have to compare legitimate offers from investment property buyers who are looking for houses like yours in your market.

Using HouseCashin is the smart way to sell your rental house.

Tax Implications of Selling an Investment Property

Let’s take a look at how taxes work when selling an investment property. This is a crucial component without which you can’t get the most of your property investing strategy.

Whether an investment is a winner or loser, financial decisions you take often involve high stakes.

- Capital losses may be mitigated with offsets against income.

- Capital gains and other taxes can be deferred, sometimes definitely. This means more equity for you to reinvest, perhaps 20-30% more from property sale proceeds.

We’ll start by outlining costs associated with selling investment properties.

Capital Gains Tax (CGT)

Capital gains taxes are imposed on the adjusted selling price of an investment property minus its adjusted purchase price. That difference is taxed at the federal level either as a long- or short-term capital gain. The tax treatment differs widely dependent on how long you have held the income producing property.

If you owned rental property for one year or less before selling it, you would have a short-term capital gain. Short term capital gains are simply taxed at ordinary individual income tax rates.

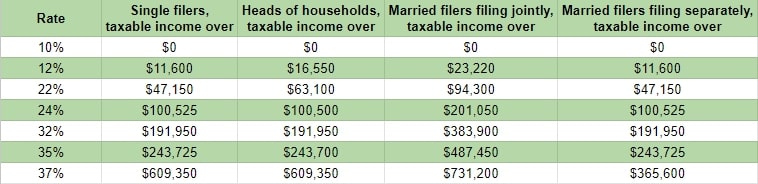

2024 Short Term Capital Gains (Ordinary) Tax Rates

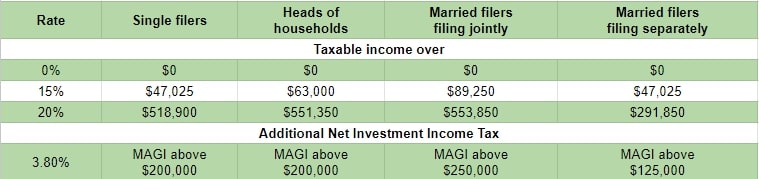

On the other hand, if you owned the asset for at least a year and one day, it would be considered a long-term capital gain. There’s a stark difference in how much tax you pay. Long-term, the first $80,800 in capital gains goes untaxed when Married Filing Jointly.

Short-term, roughly half the $80,000 is taxed at 10% with the balance at 12%, i.e. almost $9,000. It gets worse as ordinary tax rates rise to 37% long-term versus 20% short-term.

2024 Long Term Capital Gains Tax Rates

Depreciation Recapture

Depreciation is an investment or business expense. Each year as your income producing property depreciates, its tax basis declines. A depreciation schedule tracts this adjusted tax basis over time. Thereby, the tax basis of your investment property is recorded as it declines.

Depreciation recapture is assessed when an asset’s adjusted sales price exceeds its adjusted tax basis. The difference between the two amounts is recaptured at your ordinary income tax rate, capped at 25%.

When Selling for Capital Gains Exceeding Depreciation Deductions

For example, you hold rental property bought 10 years ago for $390,000. Being 39-year property, you’ve written off $100,000 ($10,000 yearly) in depreciation deductions. With an adjusted $290,000 tax basis, it’s sold for $490,000. You have a recognized $200,000 gain ($490,000 minus $290,000).

You’ll pay up to 25% (based on your ordinary tax rate capped at 25%) on the part that’s tied to depreciation deductions, or $25,000 here. The remaining $100,000 will be taxed at long-term capital gains tax rate. Assuming you’re in the 20% top bracket, that would be $20,000 in capital gains taxes. Taxes would total $55,000.

When Selling for Capital Gains Less than Depreciation Deductions

Depreciation recapture applies to the lesser of the gain or your accumulated depreciation deduction. If you sell the property for $300,000, for example, you’ll have a gain of $10,000. Since that’s less than the $100,000 depreciation deductions you’ve taken, the recapture rate of 25% applies to the entire $10,000 gain for a total tax bill of $2,500.

When Selling for a Capital Gains Loss

Depreciation recapture will not apply on losses. Say you sell for $190,000. You would report a loss of $100,000 ($290,000 adjusted tax basis minus the $190,000 sale price). While this is a big loss, you did benefit from $100,000 in depreciation expensed over the last 10 years. It could be considered a wash in that regard.

In addition, the $100,000 is considered a Section 1231 loss. This means it can be used to reduce your tax liability during the current tax year; carried back as an income offset in the previous two years or carried forward to offset future income.

It should be apparent by now that rental property tax laws are complex. Not a real estate tax pro, you’ll need professional assistance to avoid costly errors on selling these properties.

State Taxes

Individual Income Tax

In 2020, forty-three states imposed the tax on earned income with New Hampshire and Tennessee (being phased out) only taxing dividend and interest income. Seven states imposed no income tax at all. Tax Foundation’s Katherine Loughead drafted this February 2020 State Individual Income Tax Rates and Brackets for 2020 report. Included are tax-related changes effective with the 2020 tax year filing. For the current rates in your state, consult with your tax advisor or CPA.

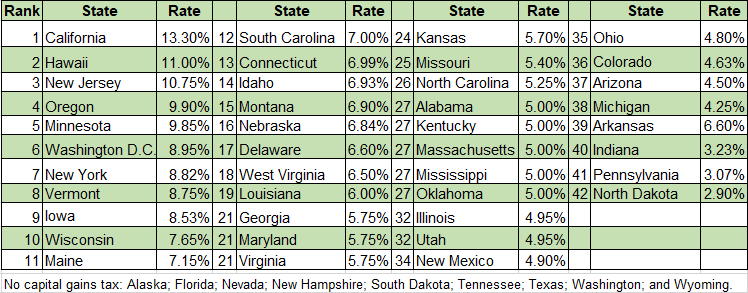

Capital Gains Tax

The top marginal tax rate on long-term capital gains is currently 3.8 percent. A 3.8% tax funding the Affordable Care Act is added to the 20% top gains rate. In addition, state and local income taxes are imposed on capital gains income. In 2020, for example, rates ranged from zero in nine states to 13.3% in California. Confirm about the current rates in your state with your CPA or tax advisor.

2020 State Capital Gains Rates Table

Transfer Tax

The transfer tax is imposed either on the buyer or seller in all thirteen states and a few localities. It is assessed on real property when ownership of the property is exchanged between parties and is included in the closing costs paid during the commercial property transaction.

All State Taxes and Fees

Wikipedia’s State government tax collections report will give you a sense of every state’s per capita burden on taxpayers. It includes income, sales/use, property, license, and other taxes.

How to Avoid Paying Capital Gains Tax on Selling a Rental Property?

Offset Capital Gains with Capital Losses

Timing is key. Yes you can offset capital gains with losses but only in the year gains occur. Unused (not having already offset gains) capital losses can be accrued and carried forward.

Current year plus accrued capital losses can offset each tax year’s new capital gains. Any residual (unused) losses are carried forward year-to-year until exhausted.

Properties must be investment holdings to qualify, not personal ones. Losses are only recognized for tax purposes when the properties are sold.

For example, you paid an adjusted $400,000 for a rental property that sold for an adjusted $350,000 two years later. Your realized capital loss is $50,000.

Note: original purchase and selling prices are typically adjusted for added costs, e.g. property improvements and selling expenses. Those cost might include real estate agents’ commissions, attorney fee, and any transfer taxes you incurred

When preparing your federal tax return:

- first, all capital gains and losses must be netted separately

- then net gains offset by net losses.

Any residual net gain is subject to tax while any remaining net loss is carried forward.

Live in Your Rental Property Before Selling

IRC Section 121 provides an exclusion of up to $500,000 of capital gains on the sale of your primary residence. This exclusion can be used once every 2 years. To qualify, you must first convert your rental real estate into a primary residence. Prior to selling, generally it must be your primary residence for at least two of the previous five years. It can be any two of those past five years that you owned the property.

If you’re single, you qualify for a $250,000 exclusion with that amount of cumulative gains sheltered from the long-term capital gains tax. Married, the exclusion is $500,000, which could save you around $75,000 in capital gains taxes.

There are some restrictions. IRC Section 121(d)(6) stipulates that the capital gains exclusion does not apply to any gains attributable to depreciation. This means depreciation recapture rules that we’ve covered here will apply.

Further, the capital gains exclusion is available only for periods the property was used as a primary residence. Since January 1, 2009, any period that the property was not used as a primary residence is deemed non-qualifying use. Accordingly, to the extent gains are allocable to non-qualifying use, those gains are not eligible for the exclusion.

For example, you rented out your property for four years after 2010 and then occupied it as a primary residence for two years. When sold the following year, your total capital gains (say $75,000) must be allocated between qualifying and non-qualifying use periods. With 2 out of 6 years qualifying, one-third of the gain or $25,000 is eligible for tax deferral.

1031 Tax-Deferred Exchange

Section 1031 Exchanges applies to properties held for investment or used in a trade or business. Section 1031 in part reading:

No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchanged solely for real property of like kind which is to be held either for productive use in a trade or business or for investment. [emphasis added]

Held for investment pertains to properties held for future appreciation. Used in a trade or business involves income producing, e.g. utilized in a business or as rental property. Finally, IRS’ focus is on intent. What are the facts and circumstances that point to your intent for holding the property?

If you sell an investment property and buy another like-kind property, no gain will be recognized on the exchange. In addition, the depreciation recapture tax is also deferred. You must hold title to both the relinquished and replacement properties. The only exception would be using a disregarded entity such as a limited liability company (LLC).

These exchanges allow you to reinvest rather than losing equity to taxes usually in the 20-30% range! There are exceptions. If all proceeds from the relinquished property aren’t reinvested, you’ll be subject to the capital gains tax on the cash boot.

If replacement properties have debt lower than those relinquished, real estate investors pay capital gains tax on the so-called mortgage boot.

A Section 1031 Exchange is a complex, rules driven process with associated costs. Professional guidance in taking a cost/benefit approach may be prudent. You can learn more about this from the article about 1031 exchange costs on our sister project PropertyCashin.

Note: you can even combine a 1031 exchange with benefiting from Section 121 if you’ve owned it as a primary residence for a certain period in the last five years. Learn more about it from our article How to Do a 1031 Exchange from a Rental Property to a Primary Residence.

1033 Tax-Deferred Exchange

Involuntary conversion insurance gains can be deferred if the owner acquires like-kind replacement property. Similar to the Section 1031 Exchange, you must hold title to both the relinquished and replacement properties.

Replacement properties qualify in casualty-related exchanges when substantially similar in related service or use. In condemnation-related exchanges, replacements must be like-kind in nature.

Again, replacement property costing less than amounts realized on exchanges will produce boot. Generally, properties lost to casualty must be replaced within two years.

Eminent domain losses have three years to acquire replacements. There’s no requirement to hold insurance proceeds until the replacement property is acquired.

721 Tax-Deferred Exchange

A Section 721 Exchange or UPREIT allows you to exchange rental property for Real Estate Investment Trust (REIT) shares or an Operating Partnership. Shares are held in lieu of replacement property. Prior to closing, sale proceeds may be held by the REIT.

You start with a 1031 Exchange for a REIT-sponsored tenant-in-common (TIC) interest. Then with a Section 721 Exchange you contribute the TIC property to a partnership. In exchange, you receive a partnership interest (called operating partnership units or OP units) managed by the REIT.

This conversion does not trigger any capital gains or depreciation recapture taxation. However, you can no longer exchange out of REITs and defer taxes. Receipt of REIT common shares for OP Units ends any tax deferral option.

You are now a passive investor having no involvement in managing REIT holdings. As with Section 1031 and 1033 Exchanges, investor goals typically include tax deferral, diversification, and estate planning. REITs do:

- offer diversification benefit often with disperse property locations and wide range of industries and asset classifications

- provide real estate appreciation and dividend income

- disarm potential inheritance conflict over division of property

- provide heirs step-up basis while avoiding all taxes deferred by the estate.

Again, these are complex tax concepts. You should consider consulting your tax professional regarding the specifics related to your situation.