FSBO Closing Costs and Fees When Selling a Home by Owner [Video Guide]

Even though the information on this web page is provided by a qualified industry expert, it should not be considered as legal, tax, financial or investment advice. Since every individual’s situation is unique, a qualified professional should be consulted before making financial decisions.

Selling a house by owner not only presents the challenge of finding a buyer yourself, but also figuring out all the typical closing costs that you will need to pay at the closing table as well as considerable out-of-pocket expenses.

In a FSBO transaction there is no listing agent to walk you through every potential cost and fee that you might incur during and after the process. Fortunately, Kristina Morales, a licensed and highly-experienced Realtor, took on this task and created a video guide where she goes over the typical costs and fees a FSBO seller can expect to pay during the ‘for sale by owner’ transaction.

This guide is one of the 4-video series on closing costs that Kristina exclusively recorded for HouseCashin platform. Here is the whole list:

- Cost of Selling a House with a Realtor

- Cost to Sell a Home by Owner (presented on this page)

- Cost to Sell a Home to a Real Estate Investor

- Closing Costs Comparison: Realtor vs. FSBO vs. Investor

How Much Does It Cost to Sell a House by Owner in the US?

In the video below, Kristina shows all closing costs classified by two types: out-of-pocket expenses and costs netted from proceeds. Then she provides an example calculation of what a seller can net for their home in a typical FSBO transaction (using the same home selling price and the rest of the parameters as in her three other guides).

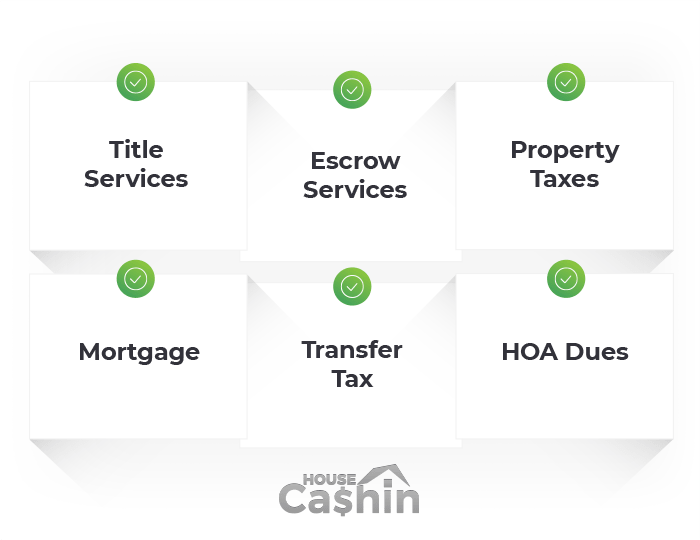

Infographic: Closing Costs when Selling a Home By Owner (FSBO)

In addition to the video, we also made this visual infographic that will help you better memorize all out-of-pocket closing costs and fees netted from proceeds. Feel free to share it with your friends and colleagues.

Video Transcription

Hi, my name is Kristina Morales and I’m a licensed real estate agent in the state of California. Today I’m going to be bringing you the next video in the closing costs series brought to you by HouseCashin. Let’s get started.

This is video two in the closing costs series and today we’re going to talk about what to expect in closing costs when selling your home as a “for sale by owner”.

What Is a FSBO?

FSBO stands for “for sale by owner”, and you’re going to hear me use that acronym throughout the presentation. FSBO is when an owner decides to sell their own property without the use of a real estate professional known as the listing agent.

Why Choose the FSBO Option?

The number one reason why sellers will choose to sell as a “for sale by owner” is to avoid paying realtor commissions. But here’s a little reality check. While the FSBO seller may avoid paying commissions to a listing agent, it is very likely that they may still need to pay a buyer’s agent fee. Why? Because according to the National Association of Realtors’ research in 2018, 87% of buyers used a real estate agent.

How Much You Save on Realtor Commission when Selling as FSBO

So, what does that mean? That means that when you’re going to sell your home, you want your home to be seen by as many buyers as you can. You want a large buyer pool. Well, 87% of the buyers last year had a real estate agent. So, if you want to be able to get your home seen by as many buyers as you can, you’ll have to expect to compensate the buyer’s real estate agent who’s bringing their buyer to your home.

As for savings on realtor fees, realistically speaking, a FSBO seller may save about two to 3% in commissions if they successfully sold as a FSBO. And that two to 3% savings come from not having to pay a listing agent.

Marketing Costs

In a physical transaction, the seller pays all marketing costs versus when you use a realtor, that realtor’s responsible for paying for the marketing cost. Let’s go through some basic marketing expenses.

Photography

This is very basic and not all inclusive, but as a FSBO you can expect that you’re going to have photography. Photography can range anywhere between $350 and $650. Of course, if your home is super large, this could be more. It depends on where you’re located and the type of marketing you’re doing. So, if you have a luxury property, it’s probably going to be more than $650.

Videography

The next thing is videography. People want to see what your home feels like, and a video is a perfect way to market your home. Videography is becoming more and more common. So, you can expect to spend anywhere between $400 to $600. Again, above or below that range, depending on the size of your home, your location, and the type of marketing you’re hoping to achieve.

Print Marketing

So, that’s your printing cost. Cost to print out brochures, costs to print out postcards, cost to print out flyers. You can expect anywhere between $300 to $500, depending on the number of prints that you request. But printing costs is a real cost and you want to have some quality print material.

Postage

If you’re hoping to send out a mail blasting—“hey everybody, my home is for sale”—well, it’s going to be anywhere between $650 and up. So that’s really depending on how many people you hope to market to and it’s very costly. But these are just some basic-basic marketing expenses that you may have if you want to try to successfully sell your home on your own.

Time

Probably the biggest cost to any seller is time and only you can equate how much your time is worth.

- What else could you be doing if you weren’t preparing your marketing plan to sell your home?

- What else could you be doing if you weren’t showing your home multiple times to multiple buyers?

- What else could you be doing if you weren’t hosting an open house?

- What else could you be doing if you weren’t following up on buyers to find out if they’re interested in making an offer on your home?

The list goes on and on. Selling your home is very time-intensive, so you have to think about what else you could be doing.

“What am I giving up since I’m deciding to sell my home myself? And is it worth it? Is saving that 2 to 3% on commission worth not being able to do other things?”

That is the question that you need to ask yourself and also answer for yourself.

Other Closing Costs

Basically, all other closing costs remain the same as when selling with a real estate agent.

Out-of-Pocket Expenses

In video one we talked about out-of-pocket expenses and we went through each of these in detail. So, if you want to go through them in detail, please go back to the video one, which is talking about these expenses.

When you’re selling with a real estate agent, most of this remains the same. Guess what’s different? There’s an additional expense, and that’s a marketing expense because marketing your home properly is how your home gets sold. And so, this is an expense that you are going to have before your home even hits the market.

Costs Netted from Proceeds

Now you have the closing costs that are netted from your proceeds at closing. Again, all of these remain the same as it was discussed previously in video one. For more details, please go back to that video.

Closing Costs Example

Now let’s walk through the example. We’re going to use the exact same example we did in the first video.

In the first example we said we had a purchase price of $250 000 and no mortgage balance. We’re going to pay commission. In this example, we’re paying 3% of the buyer’s agent commission. The escrow and the transfer tax remain the same. And we are in the state of California.

The only difference between this and the one I’m discussing in the video one is commission. So instead of paying 6% commission, you’re paying half of that, and that’s 3%.

So, in the closing costs example here, all of the actual numbers for each of the items are: commissions are at 7,500, title fee—the same as in the other example, escrow fees—the same as in the other example, and so on and so forth.

Again, the only difference between this example and the previous one is that you’ve saved half on commission. So instead of it being $15,000, it’s now $7,500.

Now, remember that the buyer’s agent doesn’t receive the full $7,500. It’s divided between the agent and the brokerage.

And here is a quick summary of the costs: in this example total closing costs are $12,640 or 5.1% of the purchase price. In video one, it was 8% of the purchase price.

This does not include the marketing costs that you have, because those were already paid for, and they’re not coming out of your closing proceeds. However, it is a consideration.

So how much did you spend and how much did you save? You spent $12,640 at closing or 5.1% of the purchase price when selling by owner vs. $20,140 or 8.1% of the purchase price if selling with an agent.

Your savings in comparison to selling with an agent are $7.500 or 3% from the purchase price, minus marketing expenses (financial and your time).

The Closing Costs Video Series

So let’s go through the closing costs series. In video one we talked about what to expect when selling your home with a real estate agent. In video two, which is this one, what to expect when you sell as a FSBO. In video three, which is going to be the next video, we’ll talk about what to expect when selling to an investor (they also called “cash house buyers”).

And finally, we’re going to wrap it up in video four with the closing costs summary, and we’re going to take it one step further and talk about some other considerations and weigh the pros and cons of each selling methodology.

Thank you so much for watching today. I hope that you found “What to Expect When Selling Your Home as a For Sale by Owner” helpful. I think what’s important is to know that you have options and just weigh those options thoroughly before you decide how you want to sell your home.

Thank you and have a wonderful day. See you in video three.