1031 Exchange of Residential Real Estate: All Basics Explained with Examples

Even though the information on this web page is provided by a qualified industry expert, it should not be considered as legal, tax, financial or investment advice. Since every individual’s situation is unique, a qualified professional should be consulted before making financial decisions.

If you’re thinking about selling an investment property and buying another, a 1031 exchange may be right for you. Possibly facing a big tax hit, it’s almost an imperative, perhaps!

You can potentially defer tens of thousands dollars in federal and state taxes by purchasing another more suitable replacement.

Starting with the basics, we’ll provide you with a clear understanding of a 1031 Exchange, its guidelines and related information.

What Is a 1031 Like Kind Exchange in Real Estate and How Does It Work?

Definition of 1031 Tax Deferred Exchange

IRS Section 1031 of the internal revenue code is an instrument that allows owners of business or investment real estate properties to relinquish (sell) old rental property and purchase new like-kind replacement(s) while deferring capital gains and other taxes.

Explanation

While this Exchange has several variations that we’ll cover, they all are carried out through a series of well-defined, mandatory steps. The most used exchange is the Delayed 1031 Exchange involving real estate investments such as residential rental properties.

With advisory services as needed, first your analysis should conclude an Exchange makes sense. If so, following these steps faithfully will complete the exchange process, You:

- retain a Qualified Intermediary (QI)

- sell the investment property to be relinquished,

- ensure sale proceeds are delivered directly to your qualified intermediary,

- identify like-kind replacement(s) ─ generally limited to three ─ within 45 days,

- send a duty letter to your QI specifically naming the identified properties,

- negotiate with the seller to purchase like-kind replacement(s),

- agree on a sales price and close,

- have your QI transfer proceeds to the title holder or title company within 180 days, and

- report any recognized capital gains on IRS Form 8824 in the year relinquished property was sold.

Pros and Cons of 1031 Exchanges

Benefits of 1031 Like-Kind Exchanges

- Deferring taxes is the primary motivation behind these exchanges. You’re allowed to exchange property(ies) for replacement(s) while deferring taxes often despite realizing large capital gains.

- Tax deferrals allow you to leverage cash otherwise expended on taxes to make further investments, building greater equity and value over time.

- They can help you scale and optimize your portfolio, e.g., either expand, consolidate, or relocate your residential real estate holdings without immediately incurring large tax hits.

- There’s opportunity to enter new markets perhaps with improved cash flow or appreciation potential. Exchanges aren’t constrained by state lines, only U.S. boundaries. This means you can diversify your risk and capitalize on growth areas.

- There are no limits on how many times you can do a 1031 deferred exchange. Caution: frequent turnovers may raise dealer issues with the IRS.

- A competent QI works with you to facilitate the exchange at a relatively low cost given potential benefits. In a standard exchange without complications, roughly $1,200 is the average cost of engaging a QI.

- Upon inheritance, your heir(s) will benefit from a cost basis reset to fair market value at the date of death. The potential now exists to permanently eliminate all gains-related taxes by selling at or below that reset FMV price.

- Ability to elect to reset your depreciation. As a property owner, you can write off depreciation of your asset to compensate for deterioration related to the wear and tear, aging or other structural obsolescence of the property.

- Greater exit flexibility, e.g. buying multiple rental properties (such as single family homes). Then being able to sell some of them at your choosing.

- Though indirectly, residences are also eligible for 1031 exchanges, with certain precautionary measures. Over time, you can turn a property from a residence to an investment property, e.g. a vacation home into a rental. Or the reverse. It’ll require renting out the relinquished (old) home or replacement respectively to tenants for a time. Learn more from our article Can I Do a 1031 Exchange on a Second or Vacation Home?

Drawbacks of 1031 Like-Kind Exchanges

As with benefits, disadvantages won’t impact you equally. You’ll need to be discerning. What factors are particularly applicable to you? Weigh both pros and cons against your specific situation.

- Generally, taxes are only deferred, not rendered tax-free forever. On sale gains are fully recognized and taxed.

- A 1031 Exchange results in a reduced basis for depreciation in the replacement. Should you cash out of your investment, tax is calculated on its purchase price less the capital gain. That deferred gain is now taxable.

- Combating strict timelines can be perilous. You have 45 days to identify property(ies) you plan to buy. Then you must close on property(ies) within 180 days of selling the first relinquished property. Missing those deadlines terminates the exchange.

- Under these time constraints, investors may be pressured into making poor, self-defeating replacement(s) acquisition decisions.

- Incurring taxable cash or mortgage boot (unless you bring an out-of-pocket case to the table) if: (a) not all relinquished property sale proceeds are expended on replacement(s) or (b) mortgage debt on your relinquished property is greater than replacement debt.

- Losses are also deferred as well as gains. Deferring losses that could have offset gains elsewhere may override benefits.

- In the future on selling that property, higher capital gains rates may be imposed. Cases in point are the 15% to 20% capital gains rate cap increase plus surviving Affordable Care Act (ACA) taxes.

What Is Like Kind Property in a 1031 Exchange?

Definition of Like Kind Property

To rephrase the question: what can you buy with 1031 exchanges that are like-kind qualified?

The term like kind property refers to two real estate assets of a similar nature regardless of grade or quality. It’s real estate property that can be exchanged without incurring any tax liability under IRC Section 1031.

Both relinquished (old) and replacement (new) properties must be located within the U.S. and be held for investment, business use, or productive use in trade.

What Qualifies for a 1031 Exchange as Like Kind Property?

Like kind property doesn’t necessarily have to be of the same type as relinquished property. For example, you can exchange a single family rental home for a commercial property.

Or you can sell a plot of land held for investment and buy a rental home instead through a 1031 exchange.

Like-kind means that the property must be:

- real estate

- held for investment, business use, or productive use in trade.

Definition of Real Estate Property

Section 1031 qualifications rules encompass assets as real property if that property is:

- with exceptions qualified under state and local law,

- identified by final IRS regulations as real property, or

- determined to be real property by reason of all facts and circumstances.

Not qualifying as like-kind property are:

- inventory

- stocks, bonds, other notes

- securities

- partnership interests among certain other assets.

Incidental Personal Property

Such property may be included in a 1031 rollover as incidental to real property acquired if that personal property:

- is usually transferred along with that real property and

- the total fair market value of personal property exchanged along with the real property represents 15% or less of the replacement(s) total value.

Lobby furniture e.g. in a multifamily residential rental could be included within the 15% cap.

Mixed Use Property

The business portion of properties with partially personal use will qualify for 1031 Exchanges. Such assets include farms, ranches, and triplexes.

Note that the personal use portion may qualify for the $250,000-$500,000 primary residence exemption under Section 121. Learn more about it from our article How Can You Do a 1031 Exchange on a Primary Residence?

Umbrella Partnership Real Estate Investment Trust

UPREITs are partnerships formed between appreciated real estate owners and Real Estate Investment Trusts. Owners contribute real estate in a 1031-like exchange for operating partnership units The same tax deferral benefits are achieved as with a 1031 exchange.

5 Common 1031 Exchange Strategies with Examples

Delayed (Forward or Starker) 1031 Exchange

Now, let’s look at the five ways you can do a 1031 Exchange so that you can choose the most appropriate one depending on the real estate investment strategies you follow.

Definition and Meaning

The most popular, a delayed 1031 exchange lets a business owner or real estate investor sell their property first. Then they look for a similar replacement property. A suitable replacement has to be identified within 45 days with a signed notice sent to a qualified intermediary, and the sale of the new property has to close within 180 days of closing on relinquished property.

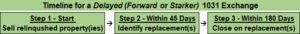

Timeline for a Delayed 1031 Exchange

Timing is central to 1031 Exchange’s ultimate success at deferring taxes.

Example

Say for ten years you’ve owned outright (debt-free) a rental unit costing $200,000. You do plan to sell the property and reinvest the capital gains in a duplex.

Working with a real estate broker, you sell the rental for $300,000 and realize a $100,000 gain. Having evoked a 1031 Exchange, your proceeds go untouched by you directly to your qualified intermediary. You and your broker have 45 days from the relinquished property’s sale date to identify like kind replacement(s) to potentially purchase.

Having located a suitable duplex for $320,000, you provide the QI with the proposed replacement’s specific identity in writing. Now you have up to 180 days for the relinquished property sale date to close.

To fully defer capital gains and depreciation recapture taxes, you’ll reinvest the $300,000 in proceeds the QI is holding. The $20,000 balance due must be financed either with cash or a loan.

Reverse 1031 Exchange

Definition and Meaning

In Reverse 1031 Exchanges replacements (new properties) are purchased prior to relinquished (old properties) being sold. Follow replacement purchases, the same standard 1031 Exchange rules and requirements must be followed.

These rules and requirements include:

- exchanges being completed within 180 calendar days of the initial closing,

- the taxpayer buying must be the same taxpayer selling,

- related party and disqualified person rules applying,

- replacement(s) must be of equal or greater value than the relinquished property to avoid taxable boot on the shortfall, and

- neither the relinquished nor replacement properties can be the primary residence of the taxpayer.

Timeline for a Reverse 1031 Exchange

The acquisition time frame regarding relinquished and replacement properties is reversed. Unlike the other main 1031 Exchanges, you:

- first acquire wanted property as replacement(s) for property to be relinquished,

- then within 45 days of the replacement purchase date, relinquished property to be sold must be identified, and

- finally within 180 days of the replacement’s purchase date, close on relinquished property.

Example

Say you’ve owned a business debt-free for 10-year property with an estimated $1M value. Selling to expand your business, you expect large capital gains and depreciation recapture tax exposures.

With the help of a business broker you locate an ideal replacement for sale at $1.5M.

Knowing several other buyers are bidding, you opt for a Reverse 1031 Exchange to quickly lock in the purchase.

Once the new business is purchased, you have 45 days to identify a seller for your old business. Again from that purchase date, you have 180 days to close on the relinquished property. With success meeting those dates and all other 1031 requirements, you’ve deferred $500,000 in capital gains and depreciation recapture taxes.

Construction or Improvement 1031 Exchange

Definition and Meaning

A construction or improvement 1031 Exchange allows you to:

- sell a property and use the proceeds to buy a similar property of lesser value and

- use the remaining cash to make build to suit renovations and improvements.

That new replacement has to be identified within 45 days and all construction/improvements must be completed within 180 days.

An Improvement 1031 exchange is only available for real estate investors. Trade or business owners must rely on either the Delayed or Reverse 1031 Exchange.

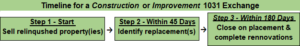

Timeline for a Construction 1031 Exchange

Example

Say you own debt-free investment property purchased 10 years ago for $1M. While its current value is an estimated $1.5M, it’s in need of renovation. You’re looking for a way out of sinking cash into fixing it up.

With a 1031 rollover of relinquished property for a $1M replacement, you’re thinking about using cash saved for now by deferring taxes on an anticipated $500,000 gain.

With the help of a real estate broker, you sell your property with all proceeds retained by your qualified intermediary. Within 45 days of the sale, you’ve identified aging investment property with that $1M asking price. That leaves you with a minimum $500,000 for renovations.

You give notice to the intermediary to commit $500,000 toward renovating the replacement. With all work completed within the mandatory 180 day time period, all taxes are deferred. No cash boot since none was left on the table.

Simultaneous 1031 Exchange

Definition and Meaning

Commonly referred to as a drop and swap exchange, it’s a concurrent 1031 swap in which relinquished property(ies) are sold and replacement(s) are acquired at the same time. A simultaneous 1031 exchange can be conducted without a Qualified Intermediary if boot isn’t involved.

Replacement(s) are under contract before relinquished property(ies) closings. The escrow companies involved can exchange proceeds directly. Constructively or not, any proceeds you receive likely invalidate the entire exchange. Also, any delay between deeds being exchanged will fail the exchange.

To avoid these and other missteps, consider using a Qualified Intermediary. QIs will sell your property(ies) and use those proceeds to buy your replacement(s). Then the same-day requirement to complete the swap doesn’t apply.

It might take a week or more but having received no proceeds, you create no exposure to taxable boot of failed exchange.

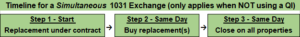

Timeline for a Simultaneous 1031 Exchange

Example

Say you are trading your triplex to another investor for her/is commercial real estate. Both properties are valued at $400,000. At closing deeds to both properties may be swapped without QI involvement in the transaction. Any capital gains and other taxes are deferred.

Partial 1031 Exchange

Definition and Meaning

Popular beliefs aside, it’s possible to buy replacement(s) for less than relinquished property(ies) receipts. Some taxes can still be deferred with the difference called cash boot being exposed to taxation.

You are not required to reinvest 100 percent of your sales proceeds. That portion not reinvested creates a cash boot subject to capital gains and depreciation recapture taxes. To execute a partial 1031 Exchange, the same rules and restrictions apply as with Delayed exchange.

If you know the replacement(s) exact cost, the QI may give you some cash on the relinquished property’s closing. Caution: your pre-exchange exchange agreement with the QI should specify cash out terms.

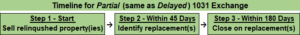

Timeline for a Partial 1031 exchange

Example

You sell debt-free relinquished property for $300,000 and acquire a replacement valued at $200,000. The $100,000 excess not invested in the replacement is taxed at ordinary tax rate.

Summary of Basic Rules and Requirements for 1031 Exchanges

Replacement Property Identification Rules and Deadlines

Three Properties Rule

How many properties you can identify is generally limited to three replacements. Regardless of value, you’ll just need to acquire and close on one of those three replacements.

Finding the right replacement(s) on time can be difficult. These 1031 rollovers must be completed titles delivered within the 180-day time period.

200% Rule

Under this rule, you can identify more than three properties provided combined values don’t exceed 200% of relinquished property(ies) fair market value. For example, an investor selling relinquished property for $1M can identify five properties valued at $400,000 each for $2M in total value.

95% Rule

With one exception, this Rule allows you to identify any number of possible replacements regardless of value. Then within the exchange period, you must acquire as replacement(s) 95% of total identified values.

Should relinquished property be sold for $1M, e.g. you could identify five properties collectively worth $2M provided acquisitions totaled $1.9M or more of the identified value.

45 Days Rule

Within the 45-day identification period starting after closing on relinquished property sales, you have to do one of two things in:

- a Reverse Exchange, identify and take title to replacement(s) or

- For all other types of exchanges (except a Simultaneous Exchange) provide your QI with a written list of the potential replacement(s) you’ll pick from.

Within that time limit, you must provide specific identifications in writing, i.e. listing property identifiers and location addresses.

180 Days Rule

Generally, investors have 180 days to complete their exchange from the relinquished property sale date. IRC Section 1031 rules requiring it be the earlier of:

- expiration of the 180 days from relinquished property sale closings or

- the federal tax return filing due date (with any extension) for the tax year within which relinquished property was sold.

Related Party Rules

Who is related to you is defined under IRC sections 267(b) or 707(b). Regarding family, they’re those closely related to you by blood: your parents, grandparents, children, grandchildren, and siblings. Also included are your spouse, nieces, nephews, aunts, and uncles.

Corporations, partnerships, and LLCs are also related parties when they’re owned primarily by a related person(s). Usually that applies to related persons owning over 50% of the entity.

Generally under Section 1031 you cannot purchase replacement(s) from a relative and still defer taxes. Properly structured, however, you can do a 1031 swap with or sell to a related party. Both parties must then hold these properties for at least two years (for safe harbor cover) post-exchange.

In one workaround, you sell a rental and buy a duplex from a relative. It’s a taxable transaction unless your relative conducts a subsequent exchange on the rental. While your duplex remains in the family, proceeds from its sale do not.

That is, with your relative’s 1031 Exchange of the rental, cash no longer remains with the family. As such, the transaction wouldn’t violate related party rules.

Caution: related party transactions are IRS red flags in general. They’ve not provided guidance on what constitutes tax avoidance. In self-defense, many practitioners apply this litmus test if:

- such property is sold at a gain,

- gains are deferred by a Section 1031 Exchange, and

- cash along with related property remain within the family unit,

then the transaction will show the tax avoidance intent violating the law.

Same Taxpayer Requirement

While the general rule is both relinquished and replacement properties must have the same owner, there are exceptions.

- In the case of taxpayer deaths, the estate can complete the exchange.

- When each spouse owns separately relinquished and replacement properties, issues arise in community property states. The IRS sees the relinquished property owner as having gifting half-ownership in replacement(s) to her/is spouse as community property.

Per the IRS, that’s a disqualifier as not being the same taxpayer.

- Irrevocable trusts replace grantors as property owners. The trust itself must take ownership of both properties for an exchange to defer taxes.

1031 Exchange Qualified Intermediary Requirements

It appears statutory intent here is promoting independent relationships between the exchangers and their QI. A Qualified Intermediary cannot be a family member, employee, financially connected person, or agent of the taxpayer. Fairly straightforward but of course there are nuances regarding:

- Disqualification of financially connected individuals ceases two years after the financial relationship ended. That period ends two years after relinquished property was sold.

- Tax and financial advisors, e.g. accountants, investment bankers, and real estate brokers are considered agents which disqualifies them.

Non-disqualifiers are persons providing services related to:

- exchanges intended to qualify for tax deferral and

- routine financial, title insurance, escrow, or trust services provided by a financial institution, title insurance company, or escrow company.

In addition, also excluded are related parties again as described under IRC sections 267(b) or 707(b).

Holding Period Requirements

Alas, there’s no specific holding period articulated by statute for how long you must hold relinquished or replacement properties.

Both properties must have been acquired with your intent to hold for investment or trade/business use being the primary motivation. That’s the IRS standard, its benchmark test for qualifying like kind 1031 property.

- Two years is often cited as a safe harbor (explained on irs.gov) but many experts consider it overly conservative.

- For years, some advisors have promoted a one year and one day approach to report exchange property on two consecutive tax returns. A calendar year would always be crossed reflecting capital gain treatment.

Case law however has led to many pros to contend anything between days and two years or longer could qualify. With the statute saying nothing, effectively the standard is what your intent was on acquiring properties.

When selling under two years from acquisition, most often your options are:

- selling outright, you pay all taxes on both relinquished and replacement properties including depreciation recapture, or

- due to unforeseen events you’re forced to sell despite an original intent to hold property for investment.

In the latter case, careful documentation of your intent to hold greatly improves your chances of prevailing on audit.

At the outset, your QI, real estate agent, and escrow officer should assist you with such documentation. In particular, retaining a competent QI is a major predictor of 1031 Exchange tax deferral ultimate success.

Frequently Asked Questions (FAQ)

How Much Does It Cost to Do a 1031 Exchange?

In terms of direct costs, QI fees typically run around $1,200 for a standard deferred 1031 exchange. With multiple properties involved each additional property can typically add $400-$600 to the bill.

With more complexity costs will rise. A good example is a Reverse 1031 Exchange with its added complexities. Costs can range anywhere between $3,500 and $7,500.

Then there’s the question of who keeps accrued interest on your escrowed funds. Relinquished property proceeds of $1M accruing 2% interest over 180 days earns $10,000 in interest. The exchange agreement with your QI should spell out that either it’s refunded to you or offsets QI costs.

Certain incidental expenses such as expedited mail charges may also be passed on to you.

How Often Can You Do a 1031 Exchange?

There are no limits on how many times you can do a 1031 exchange. As frequency increases, however, the risk for owners to be considered dealers rises.

Without demonstrable intent to hold for investment or business, tax deferrals are denied. See the previous Holding Period Requirements section for more details.

Can a 1031 Exchange Be Tax Free Rather than Tax Deferred?

When Do You Pay Taxes on a 1031 Exchange?

By default, the objective of the 1031 Exchange is to defer capital gains and other taxes.

- In some circumstances (intended or not) a portion of capital gains are taxed. If your relinquished property sale proceeds exceed replacement costs, funds left on the table are taxable cash boot.

- Or if your replacement’s mortgage is less than the relinquished property’s debt, mortgage boot may be taxable.

If later outside a 1031 Exchange you sell replacement(s) via a standard transaction, then you pay taxes on capital gains and depreciation recapture. Also potentially imposed are state taxes and the Alternative Minimum Tax (AMT).

Until real property is sold outside a 1031 Exchange, related property taxes are deferred but not forgiven. Only heirs but never original real property owners can escape taxation on selling that asset.

Can You Avoid Taxes Indefinitely?

There are two ways to potentially never pay capital gains taxes on tax-deferred replacement(s).

- For one, investors never sell and on their death, heirs enjoy a stepped-up asset cost basis to fair market value (FMV) at the date of death. Existing deferred taxes are eliminated making possible a tax-free sale. FMV equals sale proceeds (excluding closing costs considerations). Inherited property obtained through a 1031 exchange transfers to the heirs at the stepped-up market-rate value, and all deferred taxes are forgiven.

- Replacement(s) acquired in a 1031 Exchange are rented out (two years for safe harbor protection). Then the property is converted into the primary residence. Later sold, a portion or all of the Section 121 $250,000-$500,000 exclusion may apply. Learn more about it from our guide How to Do a 1031 Exchange from a Rental Property to a Primary Residence.

Do I Need a Lawyer for a 1031 Exchange?

If already quite familiar with 1031 Exchanges, you’re able to proceed on your own. However, unless you are a pro with ample time, opportunities may be missed.

Arguably benefits are so great and missteps too costly to chance going-it-alone. Time and money savings can easily exceed attorney fees while better safeguarding your exchange.

Can You Buy or Sell Multiple Properties in a 1031 Exchange?

You can exchange one property for two or more properties. Say your rental’s fair market value has tripled its original purchase price. Wanting higher income producing property, you use a 1031 Exchange to buy two high cash-flow producing rentals in a prime area.

Conversely, selling multiple properties via an exchange to consolidate holdings is equally possible. To reduce maintenance demands, relocating assets, et al, you can use an exchange to defer taxes on these sales, as well.

How to Ensure Your 1031 Exchange Is Legal and Safe?

A 1031 Exchange can be rewarding in many ways but compliance with the Rules is daunting and time-consuming. Missteps can often be unforgiving, risking exchange failures altogether.

A reputable 1031 Exchange company with tax attorneys on their team will consult you and your tax advisor/CPA and guide you through each step of the 1031 Exchange process.

Before the exchange, they will review your situation and advise on whether your plans satisfy the IRS requirements or need adjustments to perfectly comply with the rules.

HouseCashin is an all-in-one platform for residential real estate investors that maintains relationships with top-rated 1031 Exchange firms throughout the USA.

To get connected with the best professionals and have your exchange processed safely and effectively, fill out the form below.